Key Takeaways

- Regularly assess and rebalance your portfolio to maintain the desired asset allocation.

- Diversify investments across various asset classes to mitigate risk.

- Understand your risk tolerance and adjust your portfolio accordingly.

- Utilize tax-efficient strategies to enhance returns.

Establishing and maintaining a balanced investment portfolio is essential for individuals seeking both stability and long-term growth. Proper portfolio construction helps weather volatile markets and ensures your financial strategy stays aligned with your risk tolerance, time horizon, and overall goals. Regular review and thoughtful adjustments, including attention to rebalancing frequency and tax tips, are key to meeting these objectives.

Diversification, disciplined rebalancing, understanding risk, and staying tax-smart form the pillars of a resilient investment portfolio. In an unpredictable economic landscape, these strategies can empower investors to preserve capital during downturns while positioning themselves for growth during favorable market conditions. As life circumstances change, such as a new job, family expansion, or approaching retirement, it becomes increasingly important to evaluate your investment approach regularly. By making small, consistent tweaks and remaining well-informed, investors can avoid reactionary decisions and instead shape a strategy that supports their evolving needs.

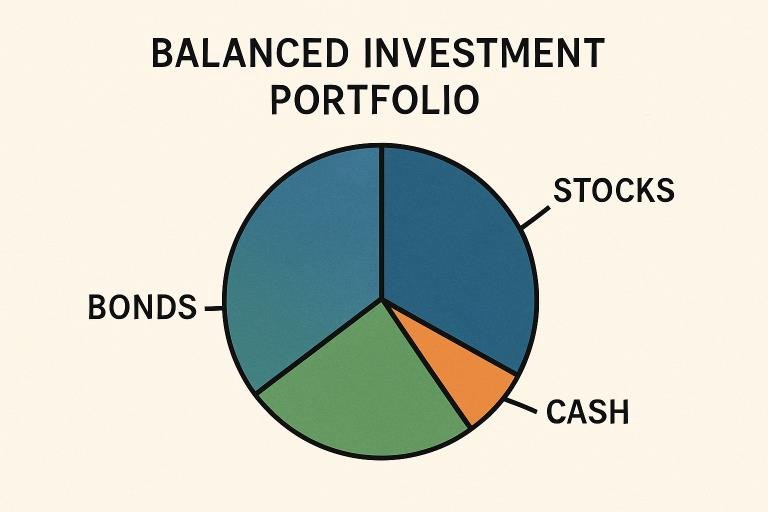

Understanding Asset Allocation

Asset allocation is the process of dividing your investments among distinct categories such as equities, fixed income, and cash equivalents. Each asset class responds differently to economic developments, which means careful allocation can limit your portfolio’s vulnerability to adverse market cycles. For example, stocks generally offer higher growth potential but come with greater volatility, whereas bonds are traditionally more stable but deliver lower returns. Determining the right blend is a function of your investment objectives, time horizon, and risk tolerance. According to Investopedia, a thoughtful asset allocation strategy is the single most important factor in determining long-term portfolio returns.

The Importance of Diversification

Diversification goes hand-in-hand with asset allocation. By spreading your investments across a variety of asset types, industries, and geographic locations, you can mitigate the impact of any single investment’s poor performance on your portfolio. For instance, while equities may decline during economic contractions, fixed income assets often provide some protection thanks to their stability and regular income. Geographic diversification is also important; exposure to both domestic and international markets can cushion your portfolio from localized economic slowdowns. The New York Times’ guide to investing recommends holding broad-based index funds as an efficient route to achieving wide diversification for individual investors.

Regular Portfolio Rebalancing

Over time, different investments will grow at varying rates, causing your portfolio to deviate from your targeted asset allocation. Rebalancing brings your holdings back in line with your desired mix, ensuring your portfolio continues to match your risk profile and investment plan. This can involve selling assets that have grown disproportionately and reinvesting in those that have lagged. Financial experts recommend reviewing your asset allocation at least annually, or in response to significant life events or large market fluctuations. Consistency is critical—waiting too long to rebalance may expose you to undesired risks or missed opportunities for growth.

Assessing Your Risk Tolerance

Risk tolerance refers to your ability and willingness to withstand declines in your investment value without making impulsive moves. Factors such as age, income stability, investing knowledge, and long-term objectives all play a role in determining your optimal risk level. For example, younger investors with decades before retirement can typically afford to be more aggressive; in contrast, those nearing financial milestones often prefer greater stability. Tools like risk assessment questionnaires and consultations with financial advisors can help you clearly define your comfort level, enabling you to make informed decisions about asset allocation.

Tax-Efficient Investing

Employing tax efficiency techniques allows you to retain more of your investment returns by minimizing tax liabilities. Utilizing tax-advantaged accounts such as RRSPs or 401(k)s can help defer taxes or shelter investments from annual income taxes. Holding positions for over a year can also qualify you for lower long-term capital gains rates. Additionally, tax-loss harvesting—selling losing investments to offset realized gains—can further reduce your taxable income.

Monitoring and Adjusting Your Portfolio

Routine monitoring is essential for maintaining alignment between your investments and your evolving financial situation. Personal circumstances, economic shifts, and changes in long-term goals all may signal the need for a portfolio adjustment. Quarterly or annual reviews, combined with attentive responses to major life events, ensure your strategy remains relevant and effective. Staying proactive and well-informed reduces the risk of emotional or ill-timed decisions, enabling sustained progress toward your financial aspirations.

Final Thoughts

By focusing on consistent rebalancing, broad diversification, appropriate risk management, and tax-smart strategies, you can build and maintain a resilient investment portfolio. Thoughtful attention to these principles will help you move forward toward your long-term financial goals—regardless of changing markets or personal circumstances.